Practice does not get you to Perfection. “Right” Practice gets perfection and so does our unique Mock Test Format. Wondering How?

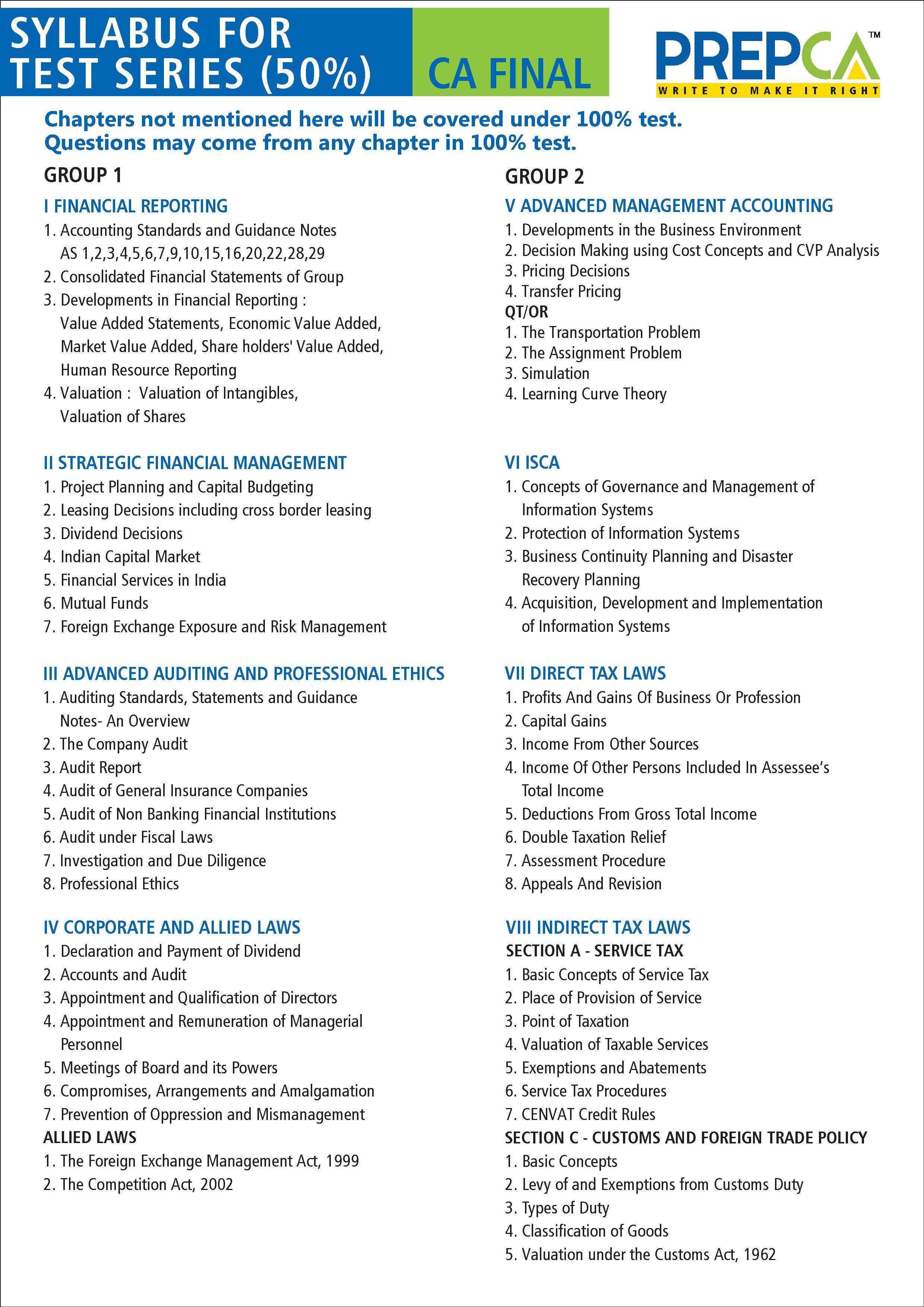

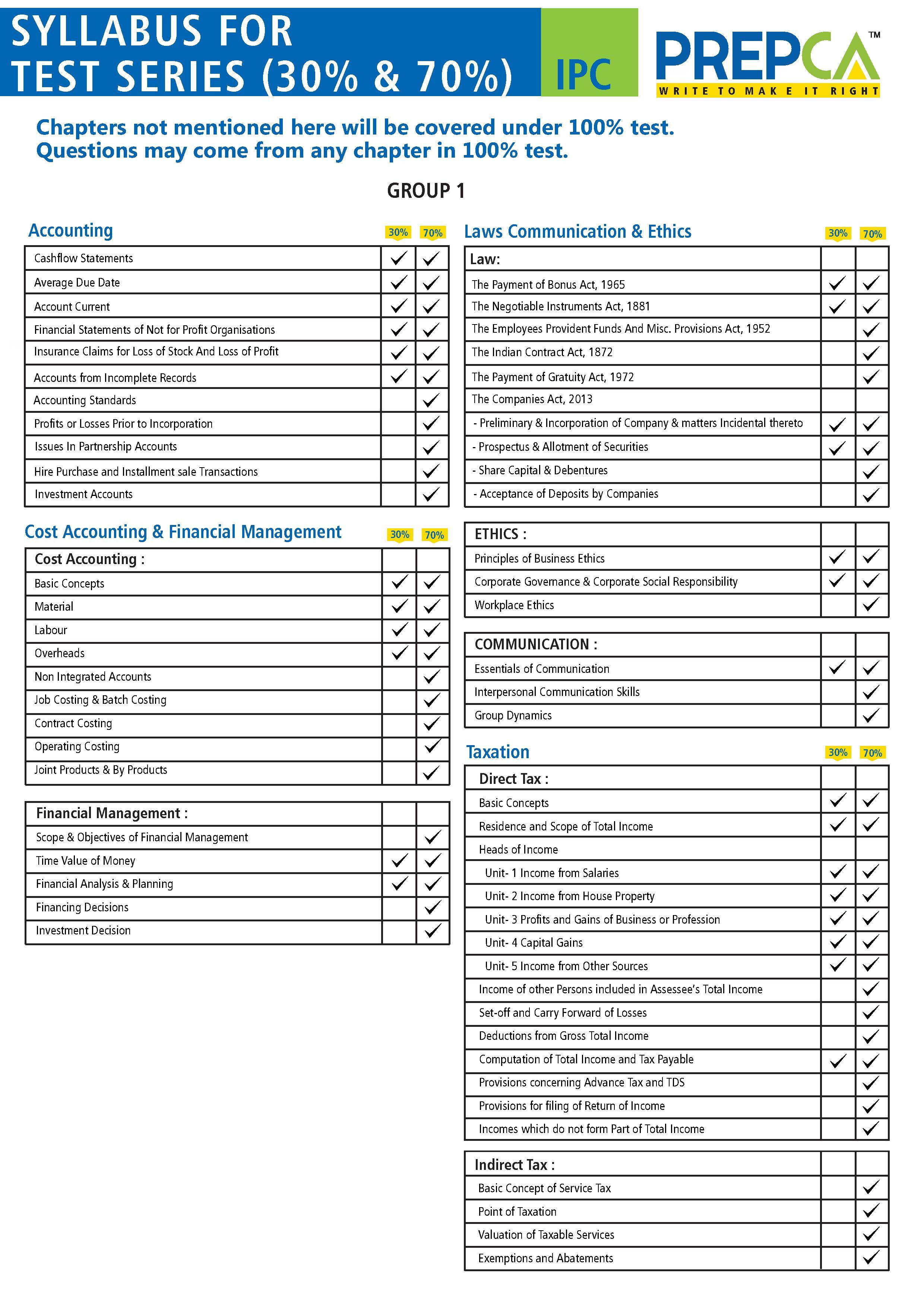

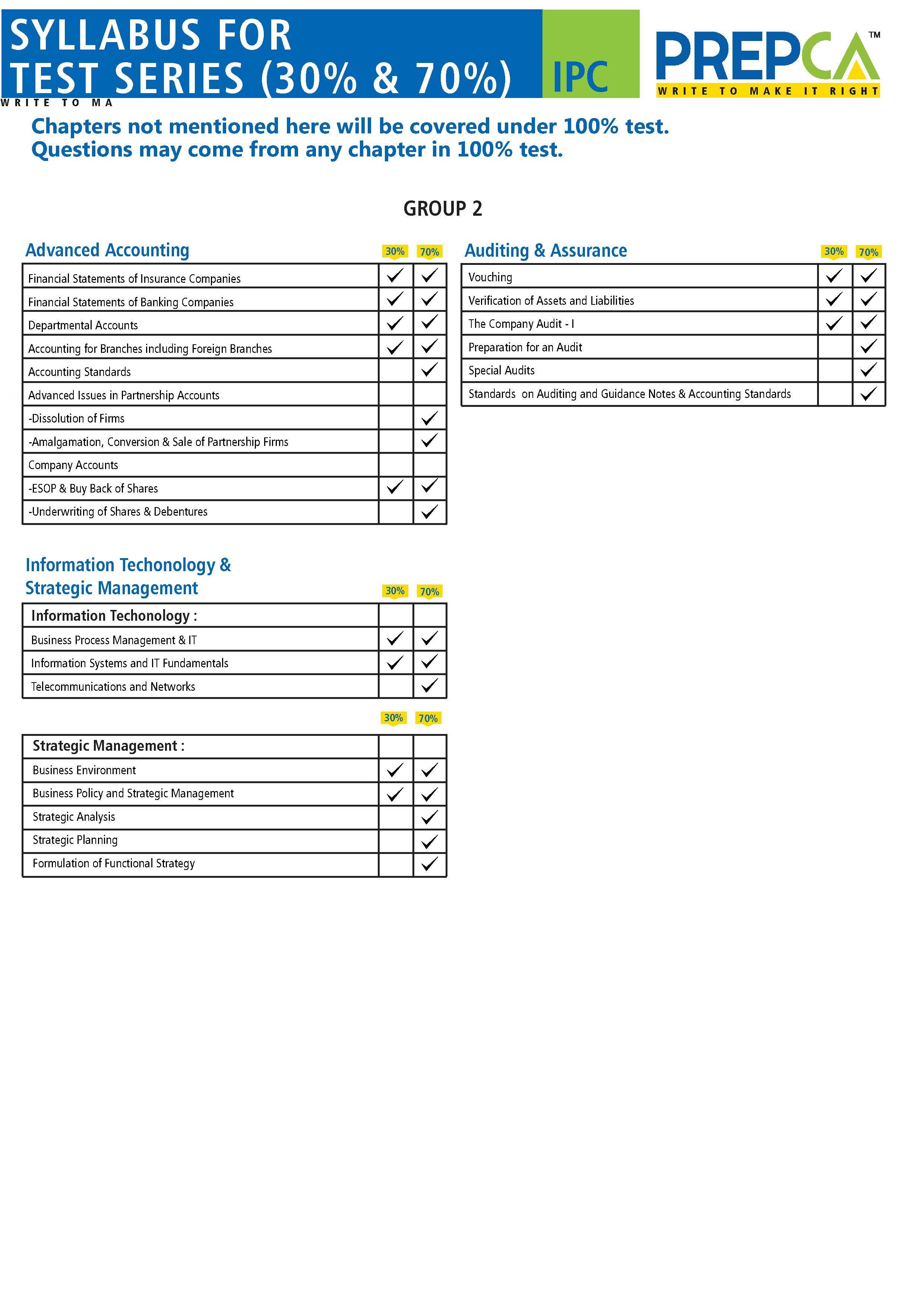

Phase 1: 30% Mock Test Series

Here we target to complete more than 1/3th of the Core CA IPCC chapters on the basis of their weightage & importance in the past examinations. This helps the students in the beginning phase of their studies for preparing a time-table as they are mostly confused on where to begin. So begin here, take the first step to clearing your CA IPCC Level through our strategized study pattern & tests.

Moreover, these tests take place in the starting month of your CA preparation so you can understand if you are studying in the right direction well in advance.

So in short the following are the key advantages:

- Understand and remember the most important 30% syllabus of IPCC with writing practice.

- Understand your areas for improvement quite before your actual exams with our chapter-wise performance analysis.

- Multiple Revision is another key advantage of this model as you can target & practice just a small part of your portion rather than directly attempting for a 100% Mock Test.

Phase 2: 70% Mock Test Series

Here we target a repetition of the first phase 30% Mock Test plus an additional 40% consisting of all the Level B priority chapters that are once again as per the weightage of the Past CA Examination. This helps you to be more than 70% prepared to write the main exam as we target to cover 90% of the Essential chapters in this 70% Mock Test.

This is the bridge you need to cross to be 110% prepared for the next phase.

Phase 3: 100% Mock Test Series A

If you have studied & tested yourself as per the above two phases, there is nothing that can prevent you from scoring your best in this last phase of our mock test series.

Prepca prepares you for a full proof test paper covering the entire syllabus of each subject to help you test your knowledge & skill before appearing for your CA Examination.

Our Programmes

- Video Counselling View Sample

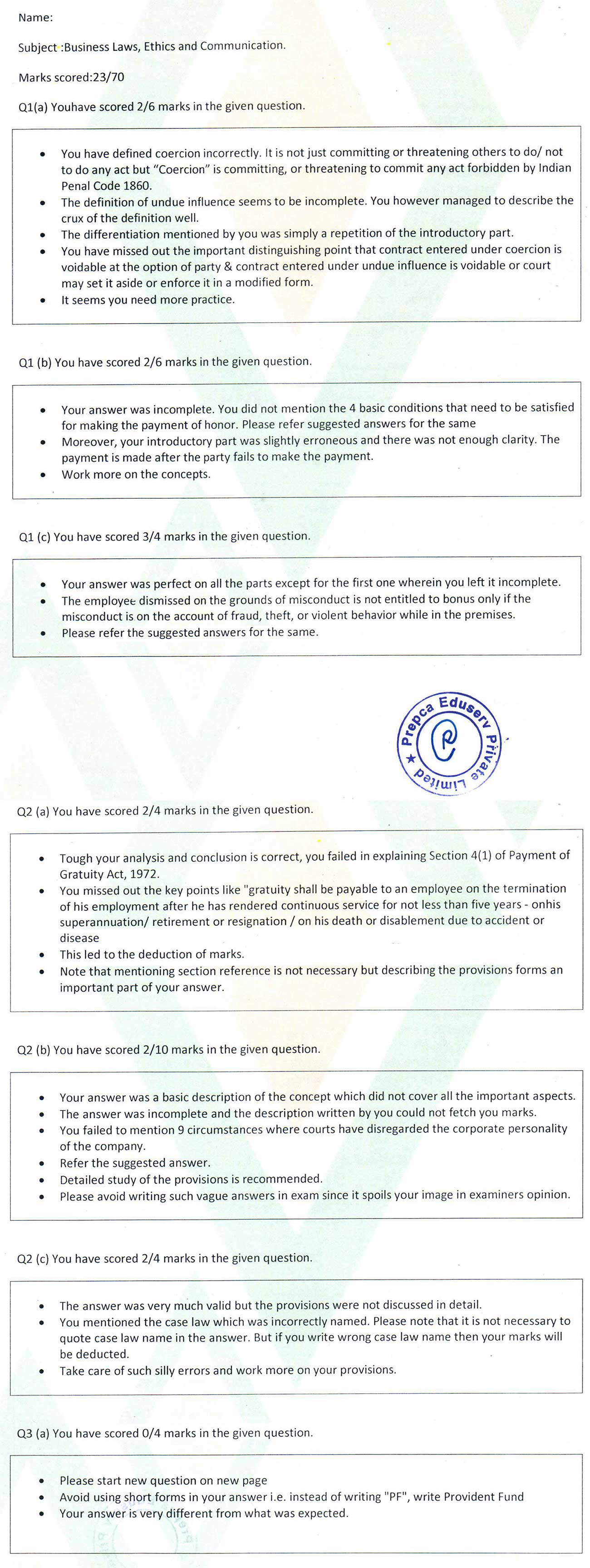

- Answer-wise Detailed Assessment Report (ADAR) View Sample

- Evaluations in 4 days View Evaluation Sample

- Bird's Eye View - Chapter-wise Analysis View Sample

- Suggested Answers

- Question Papers

- Dedicated Support/ Query Solving within 36 Working hrs

- Video Counselling

- Answer-wise Detailed Assessment Report (ADAR) View Sample

- Evaluations in 4 days View Evaluation Sample

- Bird's Eye View - Chapter-wise Analysis View Sample

- Suggested Answers

- Question Papers

- Dedicated Support/ Query Solving within 48 Working hrs

- Video Counselling

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluations in 3 days View Evaluation Sample

- Bird's Eye View - Chapter-wise Analysis View Sample

- Suggested Answers

- Question Papers

- Dedicated Support/ Query Solving within 72 Working hrs

Premium Plus Program

Video Counselling

This is a service where in you will get Video Counselling after you get your evalution from our mentors about your performance and places to improve. The Video Counselling would be for 30 minutes for each paper that you subscribe.

Evaluation

Your Answer papers will be evaluated by our Expert Evaluators.

Answer-wise Detailed Assessment Report (ADAR)

In this report you will get a detailed feedback about your performance individually for each answer that you have written. So for example if you have scored 2 out of 4 marks then you will get a feedback about why you have not scored those extra 2 marks. You need not keep searching for your mistakes in the suggested answers. It’s unique & specific to each student’s performance separately. However, for reference we will be attaching the suggested answers as well. ( View Sample Report )

Bird's Eye View - Chapter-wise Analysis

Bird’s eye view gives you a chapter-wise scoring for each subject with a rating to it. This report will enable you to understand your strengths and weaknesses chapter wise. After giving multiple tests you will be able to evaluate how you have performed chapter-wise in each tests. Please note that this feature is available only for students appearing for our multiple test model. ( View Sample Report )

Suggested Answers

You would get the actual answers for each subject as per the package selected.

Question Papers

You would get question papers for each subject as per the package selected.

Premium Program

Evaluation

Your Answer papers will be evaluated by our Expert Evaluators.

Answer-wise Detailed Assessment Report (ADAR)

In this report you will get a detailed feedback about your performance individually for each answer that you have written. So for example if you have scored 2 out of 4 marks then you will get a feedback about why you have not scored those extra 2 marks. You need not keep searching for your mistakes in the suggested answers. It’s unique & specific to each student’s performance separately. However, for reference we will be attaching the suggested answers as well. ( View Sample Report )

Bird's Eye View - Chapter-wise Analysis

Bird’s eye view gives you a chapter-wise scoring for each subject with a rating to it. This report will enable you to understand your strengths and weaknesses chapter wise. After giving multiple tests you will be able to evaluate how you have performed chapter-wise in each tests. Please note that this feature is available only for students appearing for our multiple test model. ( View Sample Report )

Suggested Answers

You would get the actual answers for each subject as per the package selected.

Question Papers

You would get question papers for each subject as per the package selected.

Standard Express Program

Evaluation in two days

Your Answer papers will be evaluated by our Expert Evaluators.

Bird's Eye View - Chapter-wise Analysis

Bird’s eye view gives you a chapter-wise scoring for each subject with a rating to it. This report will enable you to understand your strengths and weaknesses chapter wise. After giving multiple tests you will be able to evaluate how you have performed chapter-wise in each tests. Please note that this feature is available only for students appearing for our multiple test model. ( View Sample Report )

Suggested Answers

You would get the actual answers for each subject as per the package selected.

Question Papers

You would get question papers for each subject as per the package selected.

Standard Program

Evaluation

Your Answer papers will be evaluated by our Expert Evaluators.

Bird's Eye View - Chapter-wise Analysis

Bird’s eye view gives you a chapter-wise scoring for each subject with a rating to it. This report will enable you to understand your strengths and weaknesses chapter wise. After giving multiple tests you will be able to evaluate how you have performed chapter-wise in each tests. Please note that this feature is available only for students appearing for our multiple test model. ( View Sample Report )

Suggested Answers

You would get the actual answers for each subject as per the package selected.

Question Papers

You would get question papers for each subject as per the package selected.

Practice Papers Program

Suggested Answers

You would get the actual answers for each subject as per the package selected.

Question Papers

You would get question papers for each subject as per the package selected.

ICAI / Your Paper Evaluation Program

Prepca will provide you detail evaluation with a Video Counselling session from our Experts of other Test Series or Exam that you have written. You can enroll for this program if you have written any of the following question papers:

- Certified Copies of your ICAI exam i.e. Main ICAI Exam Papers

- ICAI Mock Test Papers

- Any other test series or mock tests

Rates For CA FINAL New and Old Syllabus Mock Tests

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost for each Paper | 500 |

| Cost Per Subject- 3 Papers (50%, 100%A,100%B) | 2000 |

| Cost for 1st Group after 5% discount- 12 Papers | 5700 |

| Cost for 2nd Group after 5% discount- 12 Papers | 5700 |

| Cost for Both Groups after 10% discount - 24 Papers | 10800 |

| 5% discount on One Group - Use Coupon Code 'GET5' | |

| 10% discount on Both Group - Use Coupon Code 'GET10' |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost for each Paper | 300 |

| Cost Per Subject- 3 Papers (50%, 100%A,100%B) | 1200 |

| Cost for 1st Group after 5% discount- 12 Papers | 3,420 |

| Cost for 2nd Group after 5% discount- 12 Papers | 3,420 |

| Cost for Both Groups after 10% discount - 24 Papers | 6,480 |

| 5% discount on One Group - Use Coupon Code 'GET5' | |

| 10% discount on Both Group - Use Coupon Code 'GET10' |

Test from home 3 papers

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost per Paper | 600 |

| Cost for 1st Group- 4 Papers | 2,400 |

| Cost for 2nd Group- 4 Papers | 2,400 |

| Cost for Both Groups- 8 Papers | 4,800 |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost per Paper | 300 |

| Cost for 1st Group- 4 Papers | 1200 |

| Cost for 2nd Group- 4 Papers | 1200 |

| Cost for Both Groups- 8 Papers | 2400 |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost per Paper | 350 |

| Cost for 1st Group- 4 Papers | 1400 |

| Cost for 2nd Group- 4 Papers | 1400 |

| Cost for Both Groups- 8 Papers | 2800 |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost for each Paper | 350 |

| Cost Per Subject- 3 Papers (50%, 100%A,100%B) | 1400 |

| Cost for 1st Group after 5% discount- 12 Papers | 3,990 |

| Cost for 2nd Group after 5% discount- 12 Papers | 3,990 |

| Cost for Both Groups after 10% discount - 24 Papers | 7,560 |

| 5% discount on One Group - Use Coupon Code 'GET5' | |

| 10% discount on Both Group - Use Coupon Code 'GET10' |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost for each Paper | 500 |

| Cost Per Subject- 4 Papers (30%, 70%, 100%A,100%B) | 2000 |

| Cost for 1st Group after 5% discount-16 Papers | 7,600 |

| Cost for 2nd Group after 5% discount-12 Papers | 5,700 |

| Cost for Both Groups after 10% discount- 28 Papers | 12,600 |

| 5% discount on One Group - Use Coupon Code 'GET5' | |

| 10% discount on Both Group - Use Coupon Code 'GET10' |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost for each Paper | 300 |

| Cost Per Subject- 4 Papers (30%, 70%, 100%A,100%B) | 1200 |

| Cost for 1st Group after 5% discount-16 Papers | 4,560 |

| Cost for 2nd Group after 5% discount-12 Papers | 3,420 |

| Cost for Both Groups after 10% discount- 28 Papers | 7,560 |

| 5% discount on One Group - Use Coupon Code 'GET5' | |

| 10% discount on Both Group - Use Coupon Code 'GET10' |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost for each Paper | 500 |

| Cost Per Subject- 4 Papers (30%, 70%, 100%A,100%B) | 2000 |

| Cost for 1st Group after 5% discount-16 Papers | 7,600 |

| Cost for 2nd Group after 5% discount-16 Papers | 7,600 |

| Cost for Both Groups after 10% discount-32 Papers | 14,400 |

| 5% discount on One Group - Use Coupon Code 'GET5' | |

| 10% discount on Both Group - Use Coupon Code 'GET10' |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost for each Paper | 300 |

| Cost Per Subject- 4 Papers (30%, 70%, 100%A,100%B) | 1200 |

| Cost for 1st Group after 5% discount-16 Papers | 4,560 |

| Cost for 2nd Group after 5% discount-16 Papers | 4,560 |

| Cost for Both Groups after 10% discount-32 Papers | 8,640 |

| 5% discount on One Group - Use Coupon Code 'GET5' | |

| 10% discount on Both Group - Use Coupon Code 'GET10' |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost for each Paper | 350 |

| Cost Per Subject- 4 Papers (30%, 70%, 100%A,100%B) | 1400 |

| Cost for 1st Group after 5% discount-16 Papers | 5,320 |

| Cost for 2nd Group after 5% discount-16 Papers | 5,320 |

| Cost for Both Groups after 10% discount-32 Papers | 10,080 |

| 5% discount on One Group - Use Coupon Code 'GET5' | |

| 10% discount on Both Group - Use Coupon Code 'GET10' |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost for each Paper | 350 |

| Cost Per Subject- 4 Papers (30%, 70%, 100%A,100%B) | 1400 |

| Cost for 1st Group after 5% discount-16 Papers | 5,320 |

| Cost for 2nd Group after 5% discount-12 Papers | 3,990 |

| Cost for Both Groups after 10% discount- 28 Papers | 8,820 |

| 5% discount on One Group - Use Coupon Code 'GET5' | |

| 10% discount on Both Group - Use Coupon Code 'GET10' |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost for each Paper | 500 |

| Cost Per Subject- 3 Papers (50%, 100%A,100%B) | 2000 |

| Cost for 1st Group after 5% discount- 12 Papers | 5700 |

| Cost for 2nd Group after 5% discount- 12 Papers | 5700 |

| Cost for Both Groups after 10% discount - 24 Papers | 10800 |

| 5% discount on One Group - Use Coupon Code 'GET5' | |

| 10% discount on Both Group - Use Coupon Code 'GET10' |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost for each Paper | 300 |

| Cost Per Subject- 3 Papers (50%, 100%A,100%B) | 1200 |

| Cost for 1st Group after 5% discount- 12 Papers | 3,420 |

| Cost for 2nd Group after 5% discount- 12 Papers | 3,420 |

| Cost for Both Groups after 10% discount - 24 Papers | 6,480 |

| 5% discount on One Group - Use Coupon Code 'GET5' | |

| 10% discount on Both Group - Use Coupon Code 'GET10' |

Test from home 3 papers

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost per Paper | 600 |

| Cost for 1st Group- 4 Papers | 2,400 |

| Cost for 2nd Group- 4 Papers | 2,400 |

| Cost for Both Groups- 8 Papers | 4,800 |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost per Paper | 300 |

| Cost for 1st Group- 4 Papers | 1200 |

| Cost for 2nd Group- 4 Papers | 1200 |

| Cost for Both Groups- 8 Papers | 2400 |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost per Paper | 350 |

| Cost for 1st Group- 4 Papers | 1400 |

| Cost for 2nd Group- 4 Papers | 1400 |

| Cost for Both Groups- 8 Papers | 2800 |

Test from home 1 paper

Test from center 1 paper

- Answer-wise Detailed Assessment Report (ADAR)

- Evaluation

- Bird's Eye View - Chapter-wise Analysis

- Suggested Answers

- Question Papers

| Cost for each Paper | 350 |

| Cost Per Subject- 3 Papers (50%, 100%A,100%B) | 1400 |

| Cost for 1st Group after 5% discount- 12 Papers | 3,990 |

| Cost for 2nd Group after 5% discount- 12 Papers | 3,990 |

| Cost for Both Groups after 10% discount - 24 Papers | 7,560 |

| 5% discount on One Group - Use Coupon Code 'GET5' | |

| 10% discount on Both Group - Use Coupon Code 'GET10' |

Test from home 1 paper

Test from center 1 paper

CA IPCC Mock Test(Old Syllabus)

Paper 1 : Accounting

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Chapter 1 | Accounting Standards | Yes | Yes | |

| Chapter 2 | Financial Statement of Companies | Yes | ||

| 2.1 | Final Accounts of Company | Yes | ||

| 2.2 | Cash Flow | Yes | Yes | Yes |

| Chapter 3 | Profit or Loss Pre and Post Incorporation | Yes | Yes | |

| Chapter 4 | Accounting for Bonus Issue | Yes | ||

| Chapter 5 | Internal Reconstruction | Yes | ||

| Chapter 6 | Amalgamation | Yes | ||

| Chapter 7 | Average Due Date and Account Current | Yes | Yes | Yes |

| Chapter 8 | Self Balancing Ladgers | Yes | ||

| Chapter 9 | Financial Statements of Not-For-Profit Organization | Yes | Yes | Yes |

| Chapter 10 | Accounts from Incomplete Records | Yes | Yes | Yes |

| Chapter 11 | Hire Purchase and Instalment Sale Transactions | Yes | Yes | |

| Chapter 12 | Investment Accounts | Yes | Yes | |

| Chapter 13 | Insurance Claims for Loss of Stock and Loss of Profit | Yes | Yes | Yes |

| Chapter 14 | Issues in Partnership Accounts | Yes | Yes | |

| Chapter 15 | Accounting in Computerised Environment | Yes |

Paper 2 : Business Laws, Ethics & Communication

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| LAW | ||||

| Chapter 1 | The Indian Contract Act, 1872 | Yes | Yes | Yes |

| Chapter 2 | The Negotiable Instruments Act, 1881 | Yes | Yes | Yes |

| Chapter 3 | The Payment of Bonus Act,1965 | Yes | Yes | Chapter 4 | The Employees' Provident Funds and Miscellaneous Provisions Act,1952 | Yes | Yes |

| Chapter 5 | The Payment of Gratuity Act,1972 | Yes | Yes | |

| Chapter 6 | The Companies Act,2013 | Yes | ||

| Unit 1 | Preliminary | Yes | Yes | Yes |

| Unit 2 | Prospectus -As per Companies Act,2013 | Yes | Yes | Yes |

| Unit 3 | Share Capital | Yes | Yes | |

| Unit 4 | Meetings | Yes | Yes | |

| Unit 5 | Some of the Relevant Sections- The Companies Act, 2013 | Yes | Yes | |

| Ethics | ||||

| Chapter 7 | Principles of Business Ethics | Yes | Yes | Yes |

| Chapter 8 | Corporate Governance and Corporate Social Responsibility | Yes | Yes | Yes |

| Chapter 9 | Workplace Ethics | Yes | Yes | |

| Chapter 10 | Environment & Ethics | Yes | ||

| Chapter 11 | Ethics in Marketing and Consumer Protection | Yes | ||

| Chapter 12 | Ethics in Accounting and Finance | Yes | ||

| Communication | ||||

| Chapter 13 | Essentials of Communication | Yes | Yes | Yes |

| Chapter 14 | Interpersonal Communication Skills | Yes | Yes | |

| Chapter 15 | Group Dynamics | Yes | Yes | |

| Chapter 16 | Communication Ethics | Yes | ||

| Chapter 17 | Communicating Corporate Culture, Change and Innovative Spirits | Yes | ||

| Chapter 18 | Communication in Business Environment | Yes | ||

| Chapter 19 | Basic Understanding of Legal Deeds and Documents | Yes |

Paper 3 : Cost Accounting & Financial Management

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Cost Accounting | ||||

| Chapter 1 | Basic Concepts | Yes | Yes | Yes |

| Chapter 2 | Material | Yes | Yes | Yes |

| Chapter 3 | Labour | Yes | Yes | Yes |

| Chapter 4 | Overheads | Yes | Yes | Yes |

| Chapter 5 | Non Integrated Accounts | Yes | Yes | |

| Chapter 6 | Job Costing and Batch Costing | Yes | Yes | |

| Chapter 7 | Contract Costing | Yes | Yes | |

| Chapter 8 | Operating Costing | Yes | Yes | |

| Chapter 9 | Process & Operation Costing | Yes | Yes | |

| Chapter 10 | Joint Products & By Products | Yes | Yes | |

| Chapter 11 | Standard Costing | Yes | ||

| Chapter 12 | Marginal Costing | Yes | ||

| Chapter 13 | Budgets and Budgetary Control | Yes | ||

| Financial Management | ||||

| Chapter 1 | Scope and Objectives of Financial Management | Yes | Yes | |

| Chapter 2 | Time Value of Money | Yes | Yes | Yes |

| Chapter 3 | Financial Analysis and Planning | Yes | Yes | Yes |

| Chapter 4 | Financing Decisions | Yes | Yes | |

| Chapter 5 | Types of Financing | Yes | ||

| Chapter 6 | Investment Decisions | Yes | Yes | |

| Chapter 7 | Management of Working Capital | Yes |

Paper 4 : Taxation

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Income Tax | ||||

| Chapter 1 | Basic Concepts | Yes | Yes | Yes |

| Chapter 2 | Residence and Scope of Total Income | Yes | Yes | Yes |

| Chapter 3 | Incomes Which Do Not Form Part of Total Income | Yes | Yes | Yes |

| Chapter 4 | Heads of Income | Yes | ||

| Unit 1 | Salaries | Yes | Yes | Yes |

| Unit 2 | Income from House Property | Yes | Yes | Yes |

| Unit 3 | Profits and Gains of Business or Profession | Yes | Yes | |

| Unit 4 | Capital Gains | Yes | Yes | |

| Unit 5 | Income from Other Sources | Yes | Yes | |

| Chapter 5 | Income of Other Persons Included in Assessee’s Total Income | Yes | Yes | |

| Chapter 6 | Aggregation of Income, Set-Off and Carry Forward of Losses | Yes | Yes | |

| Chapter 7 | Deductions From Gross Total Income | Yes | Yes | |

| Chapter 8 | Computation of Total Income And Tax Payable | Yes | Yes | |

| Chapter 9 | Advance Tax, Tax Deduction at Source and Introduction to Tax Collection at Source | Yes | ||

| Chapter 10 | Provisions for filing Return of Income and Self-assessment | Yes | ||

| Indirect Taxes | ||||

| Chapter 1 | GST in India - An Introduction | Yes | Yes | Yes |

| Chapter 2 | Supply under GST | Yes | Yes | Yes |

| Chapter 3 | Charge of GST | Yes | Yes | Yes |

| Chapter 4 | Exemptions from GST | Yes | Yes | |

| Chapter 5 | Time and Value of Supply | |||

| Unit 1 | Time of Supply | Yes | Yes | Yes |

| Unit 2 | Value of Supply | Yes | Yes | Yes |

| Chapter 6 | Input Tax Credit | Yes | Yes | |

| Chapter 7 | Registration | Yes | Yes | |

| Chapter 8 | Tax Invoice, Credit and Debit Notes | Yes | ||

| Chapter 9 | Payment of Tax | Yes | ||

| Chapter 10 | Returns | Yes |

Paper 5 : Advanced Accounting

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Chapter 1 | Framework for Preparation and Presentation of Financial Statements | Yes | ||

| Chapter 2 | Accounting Standards | Yes | Yes | |

| Chapter 3 | Advanced Issues in Partnership Accounts | Yes | Yes | |

| Chapter 4 | Company Accounts | Yes | ||

| -ESOPS & Buy Back of shares | Yes | Yes | Yes | |

| -Underwriting of Shares & Debentures | Yes | Yes | ||

| -Redemption of Debentures | Yes | |||

| -Amalgamation & Reconstruction | Yes | |||

| -Liquidation of Companies | Yes | |||

| Chapter 5 | Financial Statements of Insurance Companies | Yes | Yes | Yes |

| Chapter 6 | Financial Statements of Banking Companies | Yes | Yes | Yes |

| Chapter 7 | Departmental Accounts | Yes | Yes | Yes |

| Chapter 8 | Accounting for Branches including Foreign Branches | Yes | Yes | Yes |

Paper 6 : Auditing And Assurance

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Chapter 1 | Nature of Auditing | Yes | ||

| Chapter 2 | Basic Concepts in Auditing | Yes | ||

| Chapter 3 | Preparation for an Audit | Yes | Yes | |

| Chapter 4 | Internal Control | Yes | ||

| Chapter 5 | Vouching Control | Yes | Yes | Yes |

| Chapter 6 | Verification of Assets and Liabilities | Yes | Yes | Yes |

| Chapter 7 | The Company Audit - I | Yes | Yes | Yes |

| Chapter 8 | The Company Audit - II | Yes | ||

| Chapter 9 | Special Audits | Yes | Yes | |

| Chapter 10 | Standards on Auditing & Guidance Notes & Accounting Standards | Yes | Yes |

Paper 7 : Information Techonology & Strategic Management

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Information Techonology | ||||

| Chapter 1 | Business Process Management & IT | Yes | Yes | Yes |

| Chapter 2 | Information Systems and IT Fundamentals | Yes | Yes | Yes |

| Chapter 3 | Telecommunications and Networks | Yes | Yes | |

| Chapter 4 | Business Information System | Yes | ||

| Chapter 5 | Business Process Automation through Application Software | Yes | ||

| Strategic Management | ||||

| Chapter 1 | Business Environment | Yes | Yes | Yes |

| Chapter 2 | Business Policy and Strategic Management | Yes | Yes | Yes |

| Chapter 3 | Strategic Analysis | Yes | Yes | |

| Chapter 4 | Strategic Planning | Yes | Yes | |

| Chapter 5 | Formulation of Functional Strategy | Yes | Yes | |

| Chapter 6 | Strategy Implementation and Control | Yes | ||

| Chapter 7 | Reaching Strategic Edge | Yes |

CA IPCC Mock Test(New Syllabus)

Paper 1 : Accounting

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Chapter 1 | Introduction to Accounting Standards | Yes | Yes | |

| Chapter 2 | Framework for Preparation and Presentation of Financial Statements | Yes | ||

| Chapter 3 | Overview of Accounting Standards | Yes | Yes | |

| Chapter 4 | Financial Statements of Companies | Yes | ||

| Unit 1 | Preparation of Financial Statements | Yes | ||

| Unit 2 | Cash Flow Statement | Yes | Yes | Yes |

| Chapter 5 | Profit or Loss Pre and Post Incorporation | Yes | Yes | Yes |

| Chapter 6 | Accounting for Bonus Issue and Right Issue | Yes | Yes | Yes |

| Chapter 7 | Redemption of Preference Shares | Yes | Yes | Yes |

| Chapter 8 | Redemption of Debentures | Yes | ||

| Chapter 9 | Investment Accounts | Yes | Yes | Yes |

| Chapter 10 | Insurance Claims for Loss of Stock and Loss of Profit | Yes | Yes | Yes |

| Chapter 11 | Hire Purchase and Instalment Sale Transactions | Yes | Yes | Yes |

| Chapter 12 | Departmental Accounts | Yes | Yes | |

| Chapter 13 | Accounting for Branches Including Foreign Branches | Yes | Yes | |

| Chapter 14 | Accounts from Incomplete Records | Yes | Yes | |

| Chapter 15 | Partnership Accounts | Yes | ||

| Accounting Pronouncements | Yes | |||

| Part I | Framework for Preparation and Presentation of Financial Statements | Yes | ||

| Part II | Applicability of Accounting Standards | Yes | ||

| Part III | Accounting Standards | Yes |

Paper 2 : Corporate and Other Laws

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Part I | Company Law | |||

| Chapter 1 | Preliminary | Yes | Yes | Yes |

| Chapter 2 | Incorporation of Company and Matters Incidental Thereto | Yes | Yes | Yes |

| Chapter 3 | Prospectus and Allotment of Securities | Yes | Yes | Yes | Chapter 4 | Share Capital and Debentures | Yes | Yes |

| Chapter 5 | Acceptance of Deposits by Companies | Yes | ||

| Chapter 6 | Registration of Charges | Yes | ||

| Chapter 7 | Management & Administration | Yes | Yes | Yes |

| Chapter 8 | Declaration and Payment of Dividend | Yes | Yes | |

| Chapter 9 | Accounts of Companies | Yes | Yes | Yes |

| Chapter 10 | Audit and Auditors | Yes | Yes | Yes |

| Part II | Other Laws | |||

| Chapter 1 | The Indian Contract Act, 1872 | Yes | Yes | |

| Chapter 2 | The Negotiable Instruments Act, 1881 | Yes | Yes | |

| Chapter 3 | The General Clauses Act, 1897 | Yes | ||

| Chapter 4 | Interpretation of Statutes, Deeds and Documents | Yes |

Paper 3 : Cost and Management Accounting

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Chapter 1 | Introduction to Cost and Management Accounting | Yes | Yes | Yes |

| Chapter 2 | Material Cost | Yes | Yes | Yes |

| Chapter 3 | Employee Cost and Direct Expenses | Yes | Yes | Yes |

| Chapter 4 | Overheads: Absorption Costing Method | Yes | Yes | Yes |

| Chapter 5 | Activity Based Costing | Yes | Yes | Yes |

| Chapter 6 | Cost Sheet | Yes | Yes | Yes |

| Chapter 7 | Cost Accounting System | Yes | Yes | |

| Chapter 8 | Unit & Batch Costing | Yes | Yes | |

| Chapter 9 | Job Costing and Contract Costing | Yes | Yes | |

| Chapter 10 | Process & Operation Costing | Yes | Yes | |

| Chapter 11 | Joint Products & By Products | Yes | Yes | |

| Chapter 12 | Service Costing | Yes | Yes | |

| Chapter 13 | Standard Costing | Yes | ||

| Chapter 14 | Marginal Costing | Yes | ||

| Chapter 15 | Budget and Budgetary Control | Yes |

Paper 4 : Taxation

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Income Tax | ||||

| Chapter 1 | Basic Concepts | Yes | Yes | Yes |

| Chapter 2 | Residence and Scope of Total Income | Yes | Yes | Yes |

| Chapter 3 | Incomes Which Do Not Form Part of Total Income | Yes | Yes | Yes |

| Chapter 4 | Heads of Income | Yes | ||

| Unit 1 | Salaries | Yes | Yes | Yes |

| Unit 2 | Income from House Property | Yes | Yes | Yes |

| Unit 3 | Profits and Gains of Business or Profession | Yes | Yes | |

| Unit 4 | Capital Gains | Yes | Yes | |

| Unit 5 | Income from Other Sources | Yes | Yes | |

| Chapter 5 | Income of Other Persons Included in Assessee’s Total Income | Yes | Yes | |

| Chapter 6 | Aggregation of Income, Set-Off and Carry Forward of Losses | Yes | Yes | |

| Chapter 7 | Deductions From Gross Total Income | Yes | Yes | |

| Chapter 8 | Computation of Total Income And Tax Payable | Yes | Yes | |

| Chapter 9 | Advance Tax, Tax Deduction at Source and Introduction to Tax Collection at Source | Yes | ||

| Chapter 10 | Provisions for filing Return of Income and Self-assessment | Yes | ||

| Indirect Taxes | ||||

| Chapter 1 | GST in India - An Introduction | Yes | Yes | Yes |

| Chapter 2 | Supply under GST | Yes | Yes | Yes |

| Chapter 3 | Charge of GST | Yes | Yes | Yes |

| Chapter 4 | Exemptions from GST | Yes | Yes | |

| Chapter 5 | Time and Value of Supply | |||

| Unit 1 | Time of Supply | Yes | Yes | Yes |

| Unit 2 | Value of Supply | Yes | Yes | Yes |

| Chapter 6 | Input Tax Credit | Yes | Yes | |

| Chapter 7 | Registration | Yes | Yes | |

| Chapter 8 | Tax Invoice, Credit and Debit Notes | Yes | ||

| Chapter 9 | Payment of Tax | Yes | ||

| Chapter 10 | Returns | Yes |

Paper 5 : Advanced Accounting

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Chapter 1 | Application of Accounting Standards | Yes | Yes | |

| Chapter 2 | Application of Guidance Notes | Yes | Yes | |

| Chapter 3 | Accounting for Employee Stock Option Plans | Yes | ||

| Chapter 4 | Buy Back of Securities and Equity Shares with Differential Rights | Yes | ||

| Chapter 5 | Underwriting of Shares and Debentures | Yes | Yes | Yes |

| Chapter 6 | Amalgamation of Companies | Yes | ||

| Chapter 7 | Accounting for Reconstruction of Companies | Yes | ||

| Chapter 8 | Accounting for Liquidation of Companies | Yes | Yes | Yes |

| Chapter 9 | Insurance Companies | Yes | ||

| Chapter 10 | Banking Companies | Yes | Yes | Yes |

| Chapter 11 | Non-Banking Financial Companies | Yes | Yes | Yes |

| Chapter 12 | Mutual Funds | Yes | Yes | Yes |

| Chapter 13 | Valuation of Goodwill | Yes | ||

| Chapter 14 | Consolidated Financial Statements | Yes | ||

| Accounting Pronouncements | Yes | Yes | ||

| Part I | Accounting Standards | Yes | Yes | |

| Part II | Guidance Notes | Yes | Yes | |

| Part III | Accounting Standards | Yes | Yes |

Paper 6 : Auditing And Assurance

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Chapter 1 | Nature, Objective and Scope of Audit | Yes | Yes | Yes |

| Chapter 2 | Audit Strategy, Audit Planning and Audit Programme | Yes | Yes | Yes |

| Chapter 3 | Audit Documentation and Audit Evidence | Yes | Yes | Yes |

| Chapter 4 | Risk Assessment and Internal Control | Yes | Yes | Yes |

| Chapter 5 | Fraud and Responsibilities of the Auditor in this Regard | Yes | ||

| Chapter 6 | Audit in an Automated Environment | Yes | Yes | |

| Chapter 7 | Audit Sampling | Yes | ||

| Chapter 8 | Analytical Procedures | Yes | ||

| Chapter 9 | Audit of Items of Financial Statements | Yes | Yes | |

| Chapter 10 | The Company Audit | Yes | Yes | |

| Chapter 11 | Audit Report | Yes | Yes | |

| Chapter 12 | Audit of Banks | Yes | ||

| Chapter 13 | Audit of Diff erent Types of Entities | Yes | ||

| Auditing Pronouncements | Yes | |||

| Part I | Auditing and Assurance Standards | Yes | ||

| Part II | Statements | Yes | ||

| Part III | Guidance Notes | Yes |

Paper 7 : Enterprise Information Systems & Strategic Management

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Section-A | Enterprise Information Systems | |||

| Chapter 1 | Automated Business Processes | Yes | Yes | Yes |

| Chapter 2 | Financial and Accounting Systems | Yes | Yes | Yes |

| Chapter 3 | Information Systems and its Components | Yes | Yes | |

| Chapter 4 | E-Commerce, M-Commerce and Emerging Technologies | Yes | ||

| Chapter 5 | Core Banking Systems | Yes | ||

| Section-B | Strategic Management | |||

| Chapter 1 | Introduction to Strategic Management | Yes | Yes | Yes |

| Chapter 2 | Dynamics of Competitive Strategy | Yes | Yes | Yes |

| Chapter 3 | Strategic Management Process | Yes | Yes | |

| Chapter 4 | Corporate Level Strategies | Yes | Yes | |

| Chapter 5 | Business Level Strategies | Yes | Yes | |

| Chapter 6 | Functional Level Strategies | Yes | ||

| Chapter 7 | Organisation and Strategic Leadership | Yes | ||

| Chapter 8 | Strategy Implementation and Control | Yes |

Paper 8 : Financial Management & Economics for Finance

| Chapter | Title | 30% | 70% | 100% |

|---|---|---|---|---|

| Section-A | Financial Management | |||

| Chapter 1 | Scope and Objectives of Financial Management | Yes | Yes | Yes |

| Chapter 2 | Types of Financing | Yes | Yes | |

| Chapter 3 | Financial Analysis and Planning - Ratio Analysis | Yes | ||

| Chapter 4 | Cost of Capital | Yes | Yes | Yes |

| Chapter 5 | Financing Decisions - Capital Structure | Yes | Yes | Yes |

| Chapter 6 | Financing Decisions - Leverages | Yes | Yes | Yes |

| Chapter 7 | Investment Decisions | Yes | Yes | |

| Chapter 8 | Risk Analysis in Capital Budgeting | Yes | ||

| Chapter 9 | Lease Financing | Yes | ||

| Chapter 10 | Dividend Decisions | Yes | ||

| Chapter 11 | Management of Working Capital | Yes | Yes | |

| Section-B | Economics for Finance | |||

| Chapter 1 | Determination of National Income | Yes | Yes | Yes |

| Chapter 2 | Public Finance | Yes | Yes | |

| Chapter 3 | Money Market | Yes | Yes | |

| Chapter 4 | International Trade | Yes | ||

| Chapter 5 | Core Banking Systems | Yes |

CA FINAL Mock Test(Old Syllabus)

PAPER 1 : FINANCIAL REPORTING

| Chapter | Title | 50% | 100% |

|---|---|---|---|

| Chapter 1 | Accounting Standards and Guidance Notes | Yes | Yes |

| Chapter 2 | Indian Accounting Standards | Yes | Yes |

| Chapter 3 | Corporate Financial Reporting | Yes | |

| Chapter 4 | Accounting for Corporate Restructuring | Yes | Yes |

| Chapter 5 | Consolidated Financial Statements of Group Companies | Yes | Yes |

| Chapter 6 | Accounting and Reporting of Financial Instruments | Yes | |

| Chapter 7 | Share Based Payments | Yes | Yes |

| Chapter 8 | Financial Reporting for Financial Institutions | Yes | |

| Chapter 9 | Valuation | Yes | |

| Chapter 10 | Developments in Financial Reporting | Yes |

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

| Chapter | Title | 50% | 100% |

|---|---|---|---|

| Chapter1 | Financial Policy and Corporate Strategy | Yes | Yes |

| Chapter2 | Project Planning and Capital Budgeting | Yes | Yes |

| Chapter3 | Leasing Decisions | Yes | Yes |

| Chapter4 | Dividend Decisions | Yes | |

| Chapter5 | Indian Capital Market | Yes | |

| Chapter6 | Security Analysis | Yes | Yes |

| Chapter7 | Portfolio Theory | Yes | |

| Chapter8 | Financial Services in India | Yes | |

| Chapter9 | Mutual Funds | Yes | |

| Chapter10 | Money Market Operations | Yes | |

| Chapter11 | Foregin Direct Investment(FDI), Foreign Institutional Investment(FII) and International Financial Management(IFM) | Yes | |

| Chapter12 | Foreign Exchange Exposure and Risk Management | Yes | Yes |

| Chapter13 | Mergers, Acquisition and restructuring | Yes | Yes |

PAPER 3 : ADVANCED AUDITING AND PROFESSIONAL ETHICS

| Chapter | Title | 50% | 100% |

|---|---|---|---|

| Chapter 1 | Auditing Standards, Statements and Guidance Notes- An Overview | Yes | Yes |

| Chapter 2 | Audit Strategy Planning and Programming | Yes | |

| Chapter 3 | Risk Assessment and Internal Control | Yes | |

| Chapter 4 | Audit under Computerized Information System Environment | Yes | |

| Chapter 5 | Special Audit Techniques | Yes | |

| Chapter 6 | The Company Audit | Yes | Yes |

| Chapter 7 | Liability of Auditors | Yes | |

| Chapter 8 | Audit Report | Yes | Yes |

| Chapter 9 | Audit Committee and Corporate Governance | Yes | |

| Chapter 10 | Audit of Consolidated Financial Statements | Yes | |

| Chapter 11 | Audit of Banks | Yes | |

| Chapter 12 | Audit of General Insurance Companies | Yes | Yes |

| Chapter 13 | Audit of Co-operative Societies | Yes | |

| Chapter 14 | Audit of Non Banking Financial Institutions | Yes | Yes |

| Chapter 15 | Audit under Fiscal Laws | Yes | |

| Chapter 16 | Cost Audit | Yes | |

| Chapter 17 | Special Audit Assignments | Yes | |

| Chapter 18 | Audit of Public Sector Undertakings | Yes | |

| Chapter 19 | Internal Audit, Management and Operational Audit | Yes | |

| Chapter 20 | Investigation and Due Diligence | Yes | Yes |

| Chapter 21 | Peer Review | Yes | |

| Chapter 22 | Professional Ethics | Yes | Yes |

PAPER 4 : CORPORATE AND ALLIED LAWS

| Chapter | Title | 50% | 100% |

|---|---|---|---|

| Corporate Laws : | |||

| Chapter1 | Declaration and Payment of Dividend | Yes | Yes |

| Chapter2 | Accounts and Audit | Yes | Yes |

| Chapter3 | Appointment and Qualification of Directors | Yes | Yes |

| Chapter4 | Appointment and Remuneration of Managerial Personnel | Yes | Yes |

| Chapter5 | Meetings of Board and its Powers | Yes | Yes |

| Chapter6 | Inspection Enquiry and Investigation | Yes | |

| Chapter7 | Compromises, Arrangements and Amalgamation | Yes | |

| Chapter8 | Prevention of Oppression and Mismanagement | Yes | |

| Chapter9 | Winding Up | - | Yes |

| Chapter10 | Producer Companies | - | Yes |

| Chapter11 | Companies incorporated Outside India | - | Yes |

| Chapter12 | Offences and Penalties | - | Yes |

| Chapter13 | E-governance | - | Yes |

| Chapter14 | Special Courts | - | Yes |

| Chapter16 | Corporate Secretarial Practice-Drafting of Resolution, Minutes ,Notices and Reports | - | Yes |

| Insolvency and Bankruptsy Code,2016 : | Yes | Yes | |

| Allied Laws : | |||

| Chapter17 | The Securities and Exchange Board of India Act, 1992 | - | Yes |

| Chapter18 | The Securities Contracts Regulation Act, 1956 | - | Yes |

| Chapter19 | The Foreign Exchange Management Act, 1999 | Yes | Yes |

| Chapter20 | The Competition Act, 2002 | Yes | Yes |

| Chapter21 | Overview of Banking Regulation Act, 1949, The Insurance Act, 1938, The Insurance Regulatory and Development Authority Act, 1999, The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 | - | Yes |

| Chapter22 | The Prevention of Money Laundering Act | - | Yes |

| Chapter23 | Interpretation of Statues, Deeds and Documents | - | Yes |

Paper 5 : Advanced Management Accounting

| Chapter | Title | 50% | 100% |

|---|---|---|---|

| Chapter 1 | Developments in the business environment | Yes | Yes |

| Chapter 2 | Decision making using cost concepts and CVP Analysis | Yes | Yes |

| Chapter 3 | Pricing Decisions | - | Yes |

| Chapter 4 | Budget and Budgetary Control | - | Yes |

| Chapter 5 | Standard Costing | - | Yes |

| Chapter 6 | Costing of Service Sector | Yes | Yes |

| Chapter 7 | Transfer Pricing | - | Yes |

| Chapter 8 | Uniform Costing and Inter-firm Comparison | - | Yes |

| Chapter 9 | Profitability Analysis - Product wise/ Segment wise/ Customer wise | - | Yes |

| Chapter 10 | Linear Programming | Yes | Yes |

| Chapter 11 | The transportation problem | - | Yes |

| Chapter 12 | The Assignment problem | - | Yes |

| Chapter 13 | Critical Path Analysis | Yes | Yes |

| Chapter 14 | Program Evaluation and Review Technique | Yes | Yes |

| Chapter 15 | Simulation | Yes | Yes |

| Chapter 16 | Learning Curve Theory | - | Yes |

Paper 6 : Information System Control and Audit

| Chapter | Title | 50% | 100% |

|---|---|---|---|

| Chapter 1 | Concepts of Governance and Management of Information Systems | Yes | Yes |

| Chapter 2 | Information Systems Concepts | - | Yes |

| Chapter 3 | Protection of Information Systems | Yes | Yes |

| Chapter 4 | Business Continuity Planning and Disaster Recovery Planning | Yes | Yes |

| Chapter 5 | Acquisition, Development and Implementation of Information Systems | Yes | Yes |

| Chapter 6 | Auditing of Information Systems | - | Yes |

| Chapter 7 | Information Technology Regulatory Issues | - | Yes |

| Chapter 8 | Emerging Technologies | - | Yes |

Paper 7 : DIRECT TAX LAWS

| Chapter | Title | 50% | 100% |

|---|---|---|---|

| Chapter 1 | Basic Concepts | Yes | |

| Chapter 2 | Residence and Scope of Total Income | <Yes | |

| Chapter 3 | Incomes Which Do Not Form Part Of Total Income | Yes | |

| Chapter 4 | Income From Salaries | Yes | |

| Chapter 5 | Income From House Property | Yes | Yes |

| Chapter 6 | Profits And Gains Of Business Or Profession | Yes | Yes |

| Chapter 7 | Capital Gains | Yes | Yes |

| Chapter 8 | Income From Other Sources | Yes | Yes |

| Chapter 9 | Income Of Other Persons Included In Assessee’S Total Income | Yes | Yes |

| Chapter 10 | Aggeregation of Income, Set-Off And Carry Forward Of Losses | Yes | Yes |

| Chapter 11 | Deductions From Gross Total Income | Yes | Yes |

| Chapter 12 | Assessment Of Various Entities | Yes | Yes |

| Chapter 13 | Assessment of Charitable or religious trusts or institutions, political parties and electoral trusts | Yes | Yes |

| Chapter 14 | Tax Planning, tax avoidance and tax evasion | Yes | |

| Chapter 15 | Inter-Relationship Between Accounting And Taxation | Yes | |

| Chapter 16 | Deduction, Collection and Recovery of Tax | Yes | |

| Chapter 17 | Income-Tax Authorities | Yes | |

| Chapter 18 | Assessment Procedure | Yes | |

| Chapter 19 | Appeals And Revision | Yes | |

| Chapter 20 | Settlement Of Tax Cases | Yes | |

| Chapter 21 | Penalties | Yes | |

| Chapter 22 | Offences And Prosecution | Yes | |

| Chapter 23 | Liabilities in Speial Cases | Yes | |

| Chapter 24 | Miscellaneous Provisions | Yes | |

| Part II: International Taxation | Yes | ||

| Chapter 25 | Non-Resident Taxation | Yes | Yes |

| Chapter 26 | Double Taxation Relief | Yes | Yes |

| Chapter 27 | Transfer Pricing And Other Anti-Avoidance Measures | Yes | Yes |

| Chapter 28 | Advance Rulings | Yes | |

| Chapter 29 | Equalization Levy | Yes | |

| Chapter 30 | Overview of Model Tax Conventions | Yes | |

| Chapter 31 | Application and Interpretation of Tax Treaties | Yes | |

| Chapter 32 | Fundamentals of Base Erosion and Profit Shifting | Yes |

Paper 8 : Indirect Tax Laws

| Chapter | Title | 50% | 100% |

|---|---|---|---|

| Chapter 1 | GST in India - An Introduction | Yes | Yes |

| Chapter 2 | Taxable Event - Supply | Yes | Yes |

| Chapter 3 | Charge of GST | Yes | Yes |

| Chapter 4 | Exemptions from GST | Yes | Yes |

| Chapter 5 | Place of Supply | Yes | Yes |

| Chapter 6 | Time of Supply | Yes | Yes |

| Chapter 7 | Value of Supply | Yes | Yes |

| Chapter 8 | Input Tax Credit | Yes | Yes |

| Chapter 9 | Registration | Yes | Yes |

| Chapter10 | Tax Invoice, Credit and Debit Notes | Yes | Yes |

| Chapter11 | Accounts and Records | Yes | Yes |

| Chapter12 | Payment of Tax | Yes | Yes |

| Unit I | Payment of Tax, Interest and Other Amounts | Yes | Yes |

| Unit II | Tax Deduction at Source and Collection of Tax at Source | Yes | Yes |

| Chapter13 | Returns | Yes | Yes |

| Chapter14 | Refunds | Yes | |

| Chapter15 | Job Work | Yes | |

| Chapter16 | Electronic Commerce | Yes | |

| Chapter17 | Assessment and Audit | Yes | |

| Chapter18 | Inspection, Search, Seizure and Arrest | Yes | |

| Chapter19 | Demands and Recovery | Yes | |

| Chapter20 | Liability to Pay Tax in Certain Cases | Yes | |

| Chapter21 | Offences and Penalties | Yes | |

| Chapter22 | Appeals and Revision | Yes | |

| Chapter23 | Advance Ruling | Yes | |

| Chapter24 | Miscellaneous Provisions | Yes | |

| Chapter25 | Transitional Provisions | Yes | Yes |

| Part-II | Customs & FTP | ||

| Chapter1 | Levy of and Exemptions from Customs Duty | Yes | Yes |

| Unit I | Introduction to Customs Law | Yes | Yes |

| Unit II | Levy and Exemptions | Yes | Yes |

| Chapter2 | Types of Duty | Yes | Yes |

| Chapter3 | Classification of Imported and Export Goods | Yes | Yes |

| Chapter4 | Valuation under the Customs Act, 1962 | Yes | Yes |

| Chapter5 | Importation, Exportation and Transportation of Goods | Yes | |

| Unit I | Provisions Relating to Imported and Export Goods | Yes | |

| Unit II | Provisions Relating to Coastal Goods | Yes | |

| Chapter6 | Warehousing | Yes | |

| Chapter7 | Duty Drawback | Yes | |

| Chapter8 | Demand and Recovery | Yes | |

| Chapter9 | Refund | Yes | |

| Chapter10 | Provisions Relating to Illegal Import, Export, Confiscation & Allied Provisions | Yes | |

| Unit I | Provisions Relating to Prohibited/ Notified/ Specified Goods & Illegal Importation/ Exportation of Goods | Yes | |

| Unit II | Searches, Seizure and Arrest | Yes | |

| Unit III | Confiscation & Penalties | Yes | |

| Unit IV | Offences and Prosecution | Yes | |

| Chapter11 | Appeals and Revision | Yes | |

| Chapter12 | Settlement Commission | Yes | |

| Chapter13 | Advance Ruling | Yes | |

| Chapter14 | Miscellaneous Provisions | Yes | |

| Chapter15 | Foreign Trade Policy | Yes | |

| Unit I | Introduction to FTP | Yes | |

| Unit II | Basic Concepts relating to Export Promotion Schemes under FTP | Yes |

CA FINAL Mock Test(New Syllabus)

PAPER 1 : FINANCIAL REPORTING

| Chapter | Title |

|---|---|

| Chapter 1 | Application of Accounting Standards |

| Chapter 2 | Application of Guidance Notes |

| Chapter 3 | Framework for Preparation and Presentation of Financial Statements |

| Chapter 4 | Ind AS on Presentation of Items in the Financial Statements |

| Chapter 5 | Ind AS on Recognition of Revenue in the Financial Statements |

| Chapter 6 | Ind AS on Measurement based on Accounting Policies |

| Chapter 7 | Other Ind AS |

| Chapter 8 | Ind AS 101 "First-time Adoption of Indian Accounting Standards" |

| Chapter 9 | Ind AS on Assets of the Financial Statements |

| Chapter 10 | Ind AS on Liabilities of the Financial Statements |

| Chapter 11 | Ind AS on Items impacting the Financial Statements |

| Chapter 12 | Ind AS on Disclosures in the Financial Statements |

| Chapter 13 | Consolidated and Separate Financial Statements |

| Chapter 14 | Industry Specific Ind AS |

| Chapter 15 | Business Combination and Corporate Restructuring |

| Chapter 16 | Accounting and Reporting of Financial Instruments |

| Chapter 17 | Accounting for Share Based Payment |

| Chapter 18 | Analysis of Financial Statements |

| Chapter 19 | Accounting of Carbon Credits |

| Chapter 20 | Accounting for e-Commerce Business |

| Chapter 21 | Integrated Reporting |

| Chapter 22 | Corporate Social Responsibility |

| Chapter 23 | Human Resource Reporting |

| Chapter 24 | Value Added Statement |

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

| Chapter | Title |

|---|---|

| Chapter 1 | Financial Policy and Corporate Strategy |

| Chapter 2 | Indian Financial System |

| Chapter 3 | Risk Management |

| Chapter 4 | Security Analysis |

| Chapter 5 | Security Valuation |

| Chapter 6 | Portfolio Management |

| Chapter 7 | Securitization |

| Chapter 8 | Mutual Funds |

| Chapter 9 | Derivatives Analysis and Valuation |

| Chapter 10 | International Financial Management |

| Chapter 11 | International Financial Management |

| Chapter 12 | Interest Rate Risk Management |

| Chapter 13 | Corporate Valuation | Chapter 14 | Mergers, Acquisitions and Corporate Restructuring |

| Chapter 15 | International Financial Centre (IFC) |

| Chapter 16 | Startup Finance |

| Chapter 17 | Small and Medium Enterprises |

PAPER 3 : ADVANCED AUDITING AND PROFESSIONAL ETHICS

| Chapter | Title |

|---|---|

| Chapter 1 | Auditing Standards, Statements and Guidance Notes- An Overview |

| Chapter 2 | Audit Planning, Strategy and Execution |

| Chapter 3 | Risk Assessment and Internal Control |

| Chapter 4 | Special Aspects of Auditing in an Automated Environment |

| Chapter 5 | Audit of Limited Companies |

| Chapter 6 | Audit Reports |

| Chapter 7 | Audit Reports & Certificate for Special Purpose Engagement |

| Chapter 8 | Audit Committee and Corporate Governance |

| Chapter 9 | Audit of Consolidated Financial Statements |

| Chapter 10 | Audit of Banks |

| Chapter 11 | Audit of Insurance Companies |

| Chapter 12 | Audit of Non-Banking Financial Companies |

| Chapter 13 | Audit under Fiscal Laws |

| Chapter 14 | Special Audit Assignments |

| Chapter 15 | Audit of Public Sector Undertakings |

| Chapter 16 | Liabilities of Auditor |

| Chapter 17 | Internal Audit, Management and Operational Audit |

| Chapter 18 | Due Diligence, Investigation and Forensic Audit |

| Chapter 19 | Peer Review and Quality Review |

| Chapter 20 | Professional Ethics |

PAPER 4 : CORPORATE LAWS

| Chapter | Title |

|---|---|

| Section A: Corporate Laws : | |

| Chapter1 | Appointment and Qualifications of Directors |

| Chapter2 | Appointment and Remuneration of Managerial Personnel |

| Chapter3 | Meetings of Board and its Powers |

| Chapter4 | Inspection, Inquiry and Investigation |

| Chapter5 | Compromises, Arrangements and Amalgamations |

| Chapter6 | Prevention of Oppression and Mismanagement |

| Chapter7 | Winding Up |

| Chapter8 | Producer Companies |

| Section-A:Company Law | |

| Chapter9 | Companies incorporated outside India |

| Chapter10 | Miscellaneous Provisions |

| Chapter11 | Compounding of Offences, Adjudication, Special Courts |

| Chapter12 | National Company Law Tribunal and Appellate Tribunal |

| Chapter13 | Corporate Secretarial Practice – Drafting of Notices, Resolutions, Minutes and Reports |

| Section-B: Securities Laws | |

| Chapter1 | The Securities Contract (Regulation) Act, 1956 and the Securities Contract (Regulation) Rules, 1957 |

| Chapter2 | The Securities Exchange Board of India Act, 1992, SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009 and SEBI (Listing Obligations and Disclosure Requirement) Regulations, 2015 |

| Part-II: Economic Laws | |

| Chapter1 | The Foreign Exchange Management Act, 1999 |

| Chapter2 | The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 |

| Chapter3 | The Prevention of Money Laundering Act, 2002 |

| Chapter4 | Foreign Contribution Regulation Act, 2010 |

| Chapter5 | The Arbitration and Conciliation Act, 1996 |

| Chapter6 | The Insolvency and Bankruptcy Code, 2016 |

Paper-5: Strategic Cost Management and Performance Evaluation

| Chapter | Title |

|---|---|

| Sub Part-I: Strategic Cost Management | |

| Chapter 1 | Introduction to Strategic Cost Management |

| Chapter 2 | Modern Business Environment |

| Chapter 3 | Lean System and Innovation |

| Chapter 4 | Cost Management Techniques |

| Chapter 5 | Cost Management for Specific Sector |

| Chapter 6 | Decision Making |

| Chapter 7 | Pricing Decision |

| Part-B: Performance Evaluation and Control | |

| Sub Part-I: Performance Evaluation and Reporting | |

| Chapter 8 | Performance Measurement and Evaluation |

| Chapter 9 | Divisional Transfer Pricing |

| Chapter 10 | Strategic Analysis of Operating Income |

| Sub Part-II: Managerial Control | |

| Chapter 11 | Budgetary Control |

| Chapter 12 | Standard Costing |

| Chapter 13 | Case Study |

Paper 6A: Risk Management

| Chapter | Title |

|---|---|

| Chapter 1 | Introduction to RisK |

| Chapter 2 | Source and Evaluation of Risks |

| Chapter 3 | Risk Management |

| Chapter 4 | Quantitative Analysis |

| Chapter 5 | Risk Model |

| Chapter 6 | Credit Risk Measurement and Management |

| Chapter 7 | Risk associated with Corporate Governance |

| Chapter 8 | Enterprise Risk Management |

| Chapter 9 | Operational Risk Management |

Paper-6B: Financial Services and Capital Markets

| Chapter | Title |

|---|---|

| Chapter 1 | Global Financial Markets |

| Chapter 2 | Impact of various policies of Financial Markets |

| Chapter 3 | Capital Market - Primary |

| Chapter 4 | Capital Market - Secondary |

| Chapter 5 | Money Market |

| Chapter 6 | Institutions and Intermediaries |

| Chapter 7 | Commodity Market |

| Chapter 8A | Banking - Management |

| Chapter 8B | Banking as Source of Capital Including NBFCs |

| Chapter 9 | Mutual Funds |

| Chapter 10 | Private Equity |

| Chapter 11 | Investment Banking |

| Chapter 12 | Credit Rating |

| Chapter 13 | Treasury Operations |

| Chapter 14 | Risk Management |

| Chapter 15 | Credit Derivatives |

| Chapter 16 | SEBI Guidelines |

Paper-6C: International Taxation

| Chapter | Title |

|---|---|

| Part I | Taxation of International Transactions and Non-resident Taxation in India |

| Chapter 1 | Transfer Pricing |

| Chapter 2 | Non-resident Taxation |

| Chapter 3 | Double Taxation Relief |

| Chapter 4 | Advance Rulings |

| Chapter 5 | An Overview of the Black Money and the Imposition of Tax Law |

| Part II | Other aspects of International Taxation |

| Chapter 6 | Overview of Model Tax Conventions |

| Chapter 7 | Tax Treaties: Overview, Features, Application and Interpretation |

| Chapter 8 | Anti Avoidance Measures |

| Chapter 9 | Taxation of E-Commerce Transactions |

Paper-6D: Economic Laws

| Chapter | Title |

|---|---|

| Chapter 1 | World Trade Organization |

| Chapter 2 | The Competition Act, 2002 |

| Chapter 3 | Real Estate (Regulation & Development) Act, 2016 |

| Chapter 4 | Insolvency and Bankruptcy Code, 2016 |

| Chapter 5 | Prevention of Money Laundering Act, 2002 |

| Chapter 6 | The Foreign Exchange Management Act, 1999 |

| Chapter 7 | Prohibition of Benami Property Transactions Act, 1988 |

PAPER – 6 E:Globle Financial Reporting Standards

| Chapter | Title |

|---|---|

| Chapter 1 | Conceptual Framework for Financial Reporting as per IFRS |

| Chapter 2 | Application of International Financial Reporting Standards |

| Chapter 3 | Significant differences between IFRS and US GAAPs |

PAPER – 6 F: Multidisciplinary Case Study

| Chapter | Title |

|---|---|

| Chapter 1 | Financial Accounting and Reporting |

| Chapter2 | Audit and Assurance |

| Chapter3 | Taxation |

| Chapter4 | Finance and Financial Management |

| Chapter5 | Management Accounting |

| Chapter6 | Corporate Laws |

| Chapter7 | Business Strategy and Management |

Paper-7: Direct Tax Laws and International Taxation

| Chapter | Title |

|---|---|

| Part I | Direct Tax Laws |

| Chapter 1 | Basic Concepts |

| Chapter 2 | Residence and Scope of Total Income |

| Chapter 3 | Incomes Which Do Not Form Part Of Total Income |

| Chapter 4 | Salaries |

| Chapter 5 | Income From House Property |

| Chapter 6 | Profits And Gains Of Business Or Profession |

| Chapter 7 | Capital Gains |

| Chapter 8 | Income From Other Sources |

| Chapter 9 | Income Of Other Persons Included In Assessee’S Total Income |

| Chapter 10 | Aggregation of Income, Set-Off and Carry Forward of Losses |

| Chapter 11 | Deductions From Gross Total Income |

| Chapter 12 | Assessment of Various Entities |

| Chapter 13 | Assessment of Charitable or Religious Trusts or Institutions, Political Parties and Electoral Trusts |

| Chapter 14 | Tax Planning, Tax Avoidance & Tax Evasion |

| Chapter 15 | Deduction, Collection and Recovery of Tax |

| Chapter 16 | Income-tax Authorities |

| Chapter 17 | Assessment Procedure |

| Chapter 18 | Appeals and Revision |

| Chapter 19 | Settlement of Tax Cases |

| Chapter 20 | Penalties |

| Chapter 21 | Offences and Prosecution |

| Chapter 22 | Liability in Special Cases |

| Chapter 23 | Miscellaneous Provisions |

| Part II: | International Taxation |

| Chapter 1 | Chapter 1: Non-resident Taxation |

| Chapter 25 | Penalties |

| Chapter 26 | Double Taxation Relief |

| Chapter 27 | Transfer Pricing & Other Anti-Avoidance Measures |

| Chapter 28 | Advance Rulings |

| Chapter 27 | Advance Rulings |

| Chapter 28 | Equalisation Levy |

| Chapter 6 | Overview of Model Tax Conventions |

| Chapter 7 | Application and Interpretation of Tax Treaties |

| Chapter 8 | Fundamentals of Base Erosion and Profit Shifting |

Paper 8 : Indirect Tax Laws

| Chapter | Title |

|---|---|

| Goods and Services Tax | |

| Chapter 1 | GST in India - An Introduction |

| Chapter 2 | Taxable Event - Supply |

| Chapter 3 | Charge of GST |

| Chapter 4 | Exemptions from GST |

| Chapter 5 | Place of Supply |

| Chapter 6 | Time of Supply |

| Chapter 7 | Value of Supply |

| Chapter 8 | Input Tax Credit |

| Chapter 9 | Registration |

| Chapter 10 | Tax Invoice, Credit and Debit Notes |

| Chapter 11 | Accounts and Records |

| Chapter 12 | Payment of Tax |

| Chapter 13 | Returns |

| Chapter 14 | Refunds |

| Chapter 15 | Job Work |

| Chapter 16 | Electronic Commerce |

| Chapter 17 | Assessment and Audit |

| Chapter 18 | Inspection, Search, Seizure and Arrest |

| Chapter 19 | Demands and Recovery |

| Chapter 20 | Liability to Pay Tax in Certain Cases |

| Chapter 21 | Offences and Penalties |

| Chapter 22 | Appeals and Revision |

| Chapter 23 | Advance Ruling |

| Chapter 24 | Miscellaneous Provisions |

| Chapter 25 | Transitional Provisions |

| Part-II Customs & FTP | |

| Chapter 1 | Levy of and Exemptions from Customs Duty |

| Chapter 2 | Types of Duty |

| Chapter 3 | Classification of Imported and Export Goods |

| Chapter 4 | Valuation under the Customs Act, 1962 |

| Chapter 5 | Importation, Exportation and Transportation of Goods |

| Chapter 6 | Warehousing |

| Chapter 7 | Duty Drawback |

| Chapter 8 | Demand and Recovery |

| Chapter 9 | Refund |

| Chapter 10 | Provisions Relating to Illegal Import, Export, Confiscation & Allied Provisions |

| Chapter 11 | Appeals and Revision |

| Chapter 12 | Settlement Commission |

| Chapter 13 | Advance Ruling |

| Chapter 14 | Miscellaneous Provisions |

| Chapter 15 | Foreign Trade Policy |